Tokenomics: Definition and use

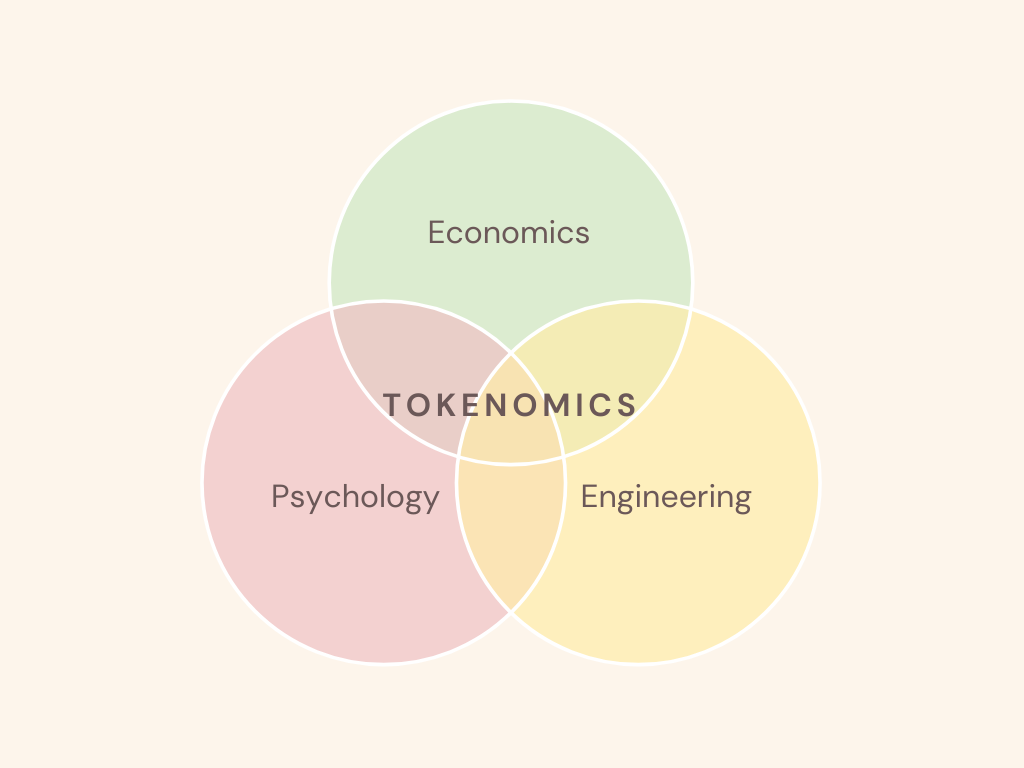

When we talk about Tokenomics we are referring to the world of cryptocurrencies and blockchain. It is essential to understand what it is and how they are distributed to be able to critically analyze different projects and make good decisions when investing or creating our own crypro project, we will try to answer the questions of What is tokenomics, How to create my own tokenomics, What should I take into account when analyzing tokenomics, How to create my own tokenomics, What should I take into account when analyzing tokenomics?

To get an idea in a simple and quick way, we can say that the tokens of a project are like shares of a company, but not like the conventional shares of a company that are issued all at the same time, in the case of tokens these can be issued gradually over time and in a fully programmed way thanks to the "code" defined in the smart contract of the Blockchain.

Tokens can be bought and sold freely through centralized or decentralized exchanges, without the need for permission or authorization from a bank or government agency. Tokens are issued by the project creator, and each project decides how they will be distributed over time and who will receive the defined token distribution. That is, what percentage will be distributed to the founding team, early investors, developers, audience, etc.; this is what is known as tokenomics.

When carrying out an analysis of a project, investors usually look at several events apart from the tokenomics, such as the graphic aspect of the websites, social networks, etc. An attractive audiovisual content, the fulfillment of the items marked in the project and a good communication can make users who own tokens to hold them and not sell them, avoiding sudden price fluctuations.

The ultimate goal of every project is to increase the value of the token over time, so one move that is often used to encourage value growth is to offer rewards in some way to holders.

What factors affect token value?

The main factors that affect the value of the token are:

1. Token distribution and allocation

One of the main handicaps that determine the value of a cryptographic token is its distribution. In which we can find two ways of acquiring them:

- Prior to release (Private sale/distribution).

- After its public release (Public sale/distribution).

When coins are acquired in the launch phase we are talking about acquiring them in the "pre-sale" phase, owning and distributing among their users the cryptocurrencies before they are publicly released. Usually a portion of the funds is sold to potential buyers through an ICO (Initial Coin Offering). It is a way to reward founders, miners and early investors with newly generated coins.

In the case of acquiring them after their public release the cryptocurrency/token is mainly acquired and managed by the company once it has been registered in some exchange or swap.

There are multiple ways to perform a token distribution (tokenomics), an example of asset distribution that can some of the projects is:

- 15% of the token for developers

- 15% of the token for ICO

- 10% of the token for Pre-ICO

- 20% of the token for Marketing

- 20% for reserveve

- 20% for staking

Number of tokens

A very important and necessary parameter for studying cryptocurrency is token provisioning. There are three main ways of supply of crypto tokens:

-Continuous supply

-Full supply

-Maximum supply

Some concepts that we should keep in mind are the "circulating supply of token" refers to the amount of cryptocurrencies that are issued and circulated in general. On the other hand, the "total token width" refers to the amount of tokens that currently exist minus the tokens that have been burned. This value is calculated with the total number of tokens that are in circulation and the tokens that are somehow locked (e.g. staked). We must not confuse the concept of "total width of a token" with that of "maximum width", as they are not synonyms, the latter refers to the maximum number of tokens that will be generated.

It is important to make an analysis of the distribution of tokens, since on many occasions developers increase the circulating supply of the token through active mining, which can cause if there is a very large increase in the number of circulating tokens, that the total capitalization is diluted in excess and this causes the price of the token to fall.

2. Market capitalization of tokens

In the context of cryptocurrencies, market capitalization is a widely used metric to determine the popularity of a token. It is calculated by multiplying the current price of the token by the circulating supply. Market capitalization is a good indicator of a token's value, even over the long term. Those cryptocurrencies with a low capitalization are the ones with the highest risk, with those with a high capitalization usually providing a higher return and security when investing.

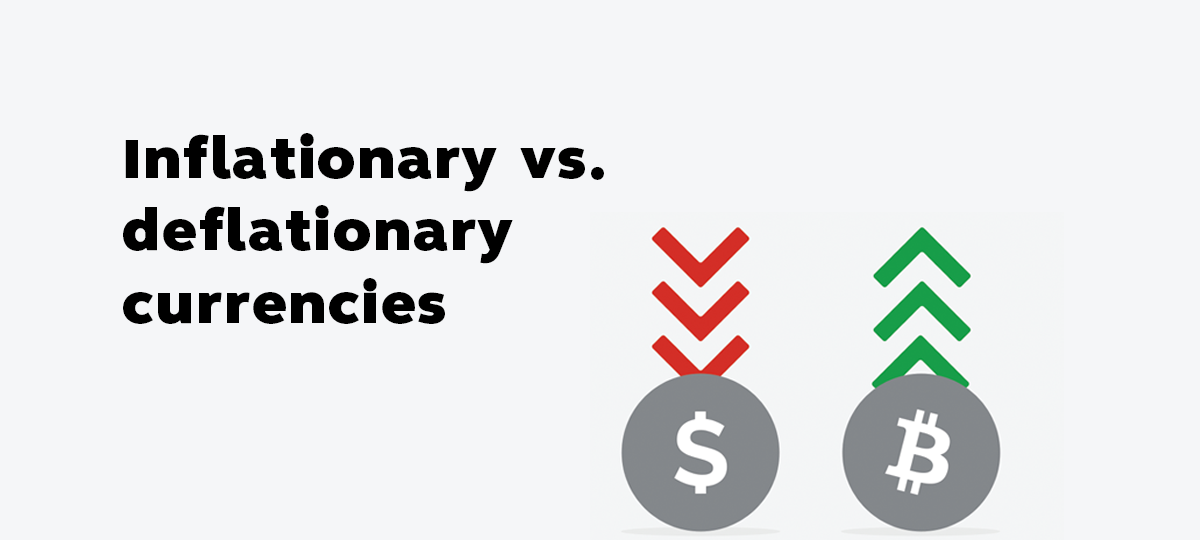

3. Token model

Each token has a form that determines its value. Some tokens are inflationary, so they do not have a maximum supply and can continue to be mined and generated over time. In contrast, deflationary tokens are those whose token width is limited to the maximum width. Deflationary tokens are useful for preventing unsold coins from being exchanged and are generally unaffected by market volatility. On the other hand, inflation tokens usually reward and enhance the work of network miners, delegators and validators.

4. Stable price

In the study of tokenomics it is also important to study the impact of price stability. Cryptocurrencies are known for their volatility, which is not always beneficial for the investor. Volatility often causes investors to lose interest. In addition, fluctuations can lead to network limitations. Investors must ensure that the project does everything possible to protect against such fluctuations. The challenge can be solved by ensuring that there are enough tokens to match supply and demand. This will stabilize the price and therefore investors can use the tokens for their intended purpose.

Token generation models

Knowing the amount of tokens to be issued, the amount in circulation and the amount of tokens issued daily is the first thing we should analyze when studying or generating a project, we have different token generation models:

Inflationary model

In this form of distribution the tokens will be constantly released/produced over time, without being limited the supply of the token. Inflation is not an increase in asset prices, but a decrease in purchasing power, contributing to the dilution of total capital. A currency can have the same price and still lose its intrinsic value if an additional 15% of the asset enters the market. Most proof-of-stake tokens, such as Ethereum and Polkadot, are infringed to reward validators and delegates responsible for validating transactions on the blockchain network. For example, Cosmos (ATOM) has an inflation rate of between 7.5 and 20%, depending on the amount of coin generated. However, there are cryptocurrencies such as Dogecoin and SLP that feature unlimited supply.

To compensate for this inflationary model what can be done is to employ a form of token "burning", helping to reduce the supply of tokens, slowing the dilution of the total capitalization and therefore increasing the value of the tokens. This burn is usually preset per use, so that the more the cryptocurrencies are used the higher the token burn.

Deflationary model

This model is used by well-known cryptocurrencies such as Bitcoin, the amount of tokens to be generated is limited and will never change. This creates a deflationary currency where even if demand were to increase, supply would not increase.

As an advantage of this form of token generation we find that being supply limited generates a natural demand as supply decreases. It also completely eliminates the concern about inflation. As a negative aspect we can find that the deflationary model could cause that by having a limited number of tokens users acquire them and accumulate them instead of using them and without spending or using them. If the token ceases to be traded, it could lose value.

Some examples of cryptocurrencies that use this model are Bitcoin (BTC) and Cardano (ADA).

Double token model

In this model, two separate tokens are used, deployed on the same blockchain, one is used as a funding model and the other as a utility token. This new type of model is a way to regulate those tokens with an inflationary model, in addition to the added security of dual tokens, it also allows more flexibility for projects, as each of the tokens can possess its own characteristics.

Some examples of tokens using this model are Vechain, Vechain / Thor (VET/VTHO) and Maker / DAO (MKR/DAI).

Asset-backed model

Some cryptocurrencies have chosen to back their token in another cryptoasset. In this model the value of the token is a function of the value of the underlying asset. The most commonly used asset backing is Tether, which is itself supposedly backed by the U.S. dollar. Tokens backed by digital assets that lack volatility can be an attraction for investors. However, we must be sure of the backing value on which the token is held as this is critical in analyzing the trust and confidence in the token.